THIS IS NOT AN ADVERTISEMENT ON GET RICH QUICK SCHEME. THIS IS INFORMATION AND TIPS ON HOW TO HANDLE COLLECTION AGENTS.

Are you currently behind in your loan payment and currently sitting on a pile of debt? Being harassed by Banks lately or by people hired by the Banks called Debt Collection agencies where some of them are masquerading as lawyers? Feeling hopeless, scared and embarrassed by the threats of losing your job, your car or your house?

Please choose your answer below:

A: Yes, definitely

B: Not yet, but coming soon

C: Maybe, but I think I’m okay (for now)

D: No, I am super rich, I don’t have a problem

E: No, I or my father or my grandfather owns the Banks and too big to go to jail. Muah! Ha! Ha! Ha!

F: I work for the Bank or Collection Agency. Why are you doing this? You are destroying our “weapons”

G: If this is a get rich quick scheme, I’m sorry, I’m not interested.

If your answer is D and E, you can skip reading this article. If your answer is G, no this is not a get rich quick scheme. If your answer is F, don’t worry, I understand your problem. There are some borrowers who simply do not want to pay unless sufficiently “pressured” and there are some who are simply a pain in the ass. I may highlight the predicaments of the collection guys in another article.

I just want to give a level playing field in this area since there are guidelines and procedures to follow and sometimes it has been abused by the Banks' personnel and Collection Agencies' staffs taking advantage of some gullible borrowers even if they “deserved” it. Enough of that and if I need to repeat myself, it is just giving some basic understanding and a level playing field and by the way, I am no angel either.

If your answer is A, B or C, don’t fret, help is on the way. No, I am going to help you pay your debts, but I would like to share some information that may alleviate your fears and may help you handle the situation in a more subdued or calm manner.

MALAYSIA'S HOUSEHOLD DEBT REACHING ALARMING LEVELS

According to the Central Bank of Malaysia’s recent report, Malaysia’s household debt has reached 86% of GDP, the highest in Asia (congratulations, we are number 1!) which works out to roughly around RM755++ billion (RM755,000,000,000). This figure changes everyday but we have reach a very worrying figure. GDP by the way is subjective and is also financed by debt but we shall discuss that in another post.

Let’s concentrate on the household debt and by looking at the figure, it is alarming indeed and it may well be close to or already reached RM1 trillion (RM1,000,000,000,000) if we take the “illegal” loans given by loan sharks into consideration.

WHEN THERE'S DEBT, THERE WILL BE DEFAULT

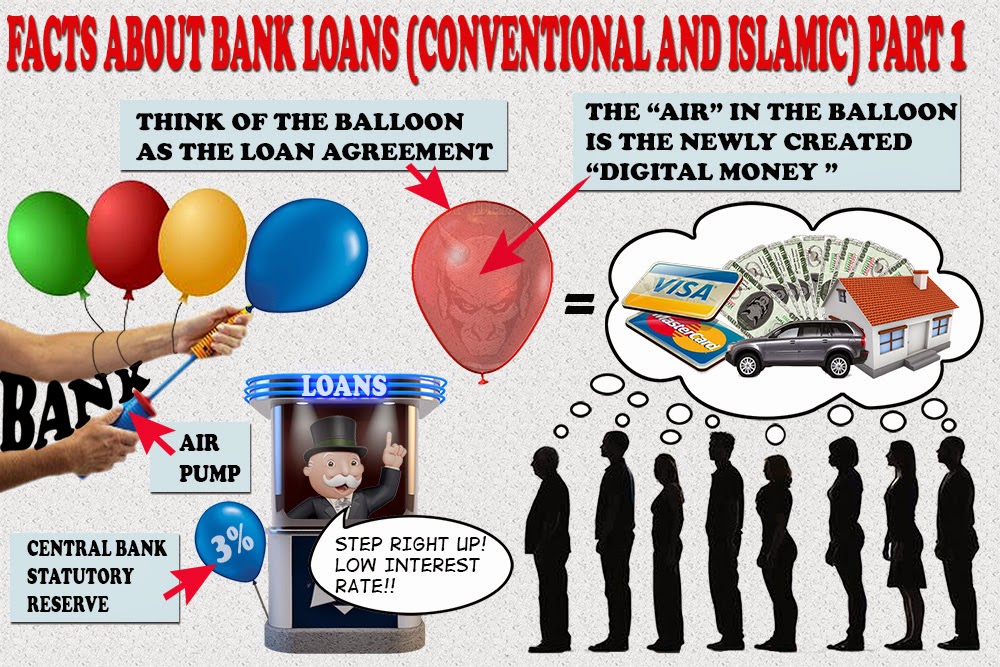

In order to understand “default” in loans, we need to understand the loan creation process. When loans are given, money are created out of thin air digitally as book keeping entries in the Bank’s computer. Interest charged are not created as money but is designed to eat up or steal the numbers from the newly created loan so that in order to service the loan in full, the borrowers would have to take from the existing money supply which incidentally are created in the same manner (with interest) so there will not be enough money unless “new” digital money are created through loans. Confused? Perhaps the diagrams below can give you some understanding.

For more details, you can view the slideshare presentation of the "Facts of Paper and Digital Money" here:

Facts about Paper Money

Facts about Paper Money

END OF PART 1.

No comments:

Post a Comment

Kindly leave your comments here. Mind your language though and be precise and relevant to the current discussion. If you need to post something else, create a new comment. Thank you